Program Requirements

The course catalog you started EMU under dictates your program requirements.

Five required courses (15 credits):

- FIN 354 Investments

- FIN 355 Financial Modeling

- FIN 358 Financial Statement Analysis

- FIN 359 Intermediate Financial Theory

- FIN 450W Problems in Financial Management

Three restricted electives (9 credits) from the following:

- FIN 451 Introduction to Financial Risk Management

- FIN 453 Commercial Banking

- FIN 455 Fixed Incomes

- FIN 456 Wealth Management

- FIN 457 International Finance

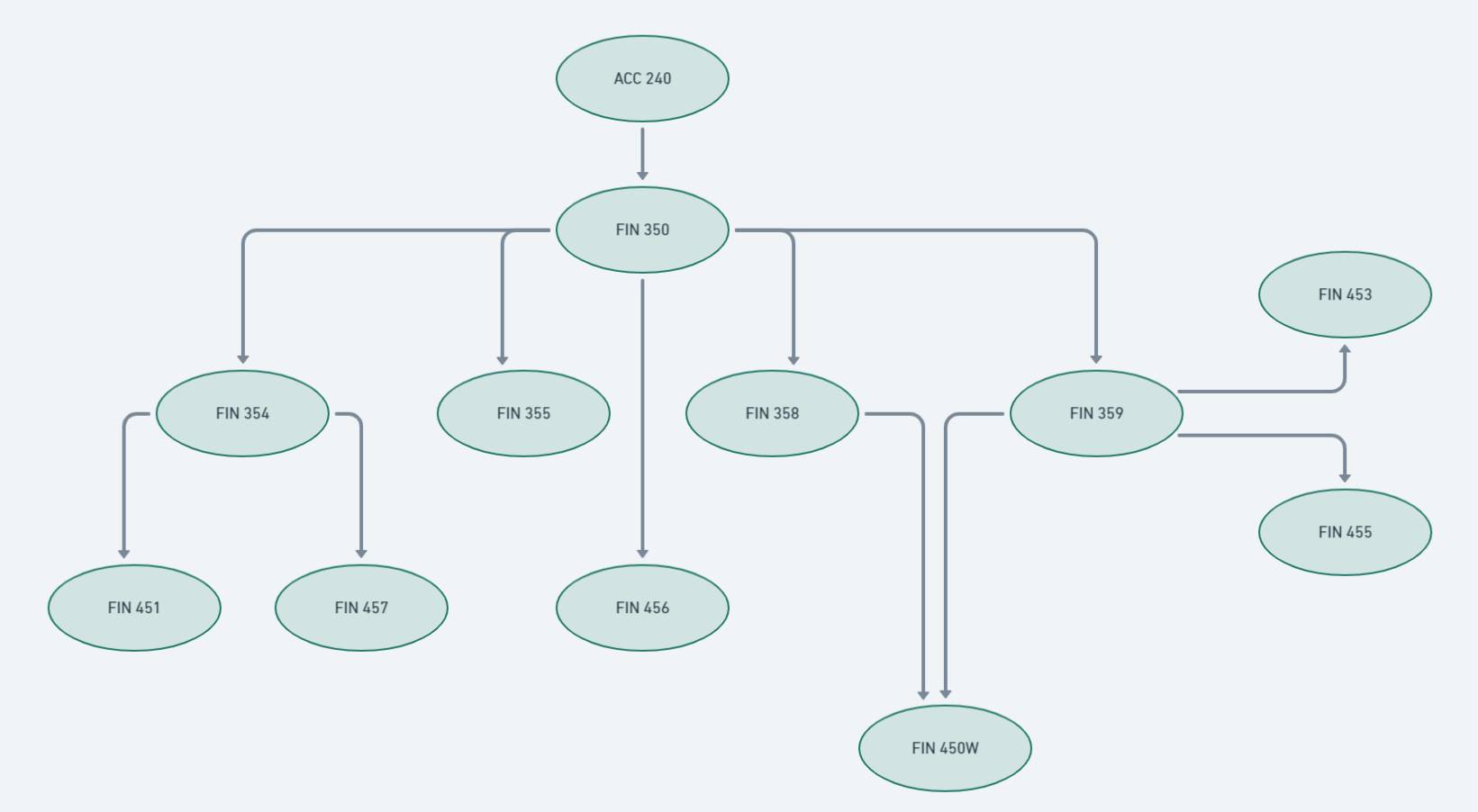

Program Course Flow

Below is a course flow diagram taking into account prerequisites. For example, per the diagram, FIN 354 is a prerequisite for FIN 451 and FIN 457 and must be successfully completed prior to registering for FIN 451 and FIN 457.

Suggested Program Map

To assist with course scheduling, the following programs maps are available:

- Students are encouraged to follow the Finance BBA [PDF] map.

- Transfer students are encouraged to follow the Finance BBA Transfer Student [PDF] map.

- Students double majoring in finance and accounting are encouraged to follow the Finance-Accounting Dual Major [PDF] map.

Scheduling Notes

- Students who are attending part-time need to adjust their schedule appropriately, including summer enrollment.

- Ensure all prerequisite and graduation requirements are met by verifying with an advisor and performing a degree audit [PDF].

- General education courses shall be selected from the university approved list of courses.