Retirement Savings Plan

We want you to enjoy your retirement. Planning ahead is a good place to start. We have two retirement plans available at EMU. See which one you qualify for:

- TIAA-CREF is for all employees of Eastern.

- Michigan Public School Employees Retirement System (MPSERS) is only available if you started working for a university before 1995, opted for MPSERS at that time and would like to continue. If you are in MPSERS, you can elect to have contributions come out of your paycheck and go into the EMU TIAA-CREF plan, however there will be no EMU employer match.

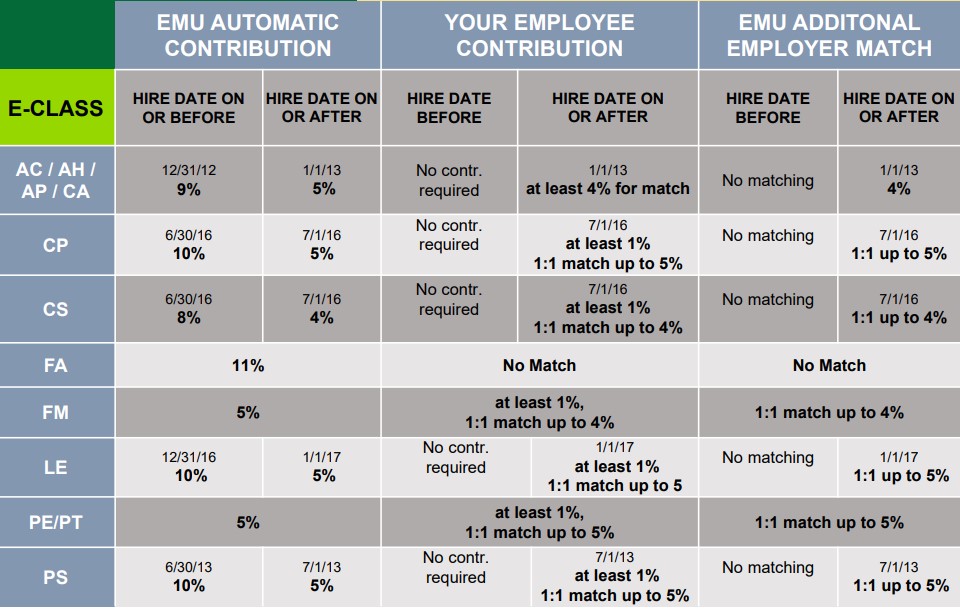

EMU offers a 403(b) Supplemental Retirement Account Savings (SRA) Plan. As shown in the chart below, based on your E-Class and hire date, eligible employees receive the EMU Automatic contribution and can obtain the EMU Additional Employer match by contributing to the 403b. Vesting differs by Employee class.

EMU also offers a 457(b) pre-tax and a 457(b) ROTH (after-tax) Plan. These plans do not allow for

loans but catch-up contributions are also permitted. IRS maximums apply.

How Healthy Are You, Financially?

Keeping fiscally fit is more important than ever before. TIAA offers a personal financial organizer which includes financial wellness tips, tools and checklists to help you organize your finances and plan for your future. Get yourself a financial checkup and download your personal financial organizer [PDF].

In addition, TIAA-CREF comes to campus twice a month for individual counseling sessions to help you with your account. To make an appointment, visit the TIAA schedule site or call 800.732.8353.

Obtaining a Loan or Withdrawal from your Supplemental Retirement Account

Loan Administration Procedures from 403(b) Voluntary Retirement Plan

- EMU & TIAA Loan Program [PDF]

- You must have a 403(b) in place before applying for a loan.

- Contact TIAA at 800.842.2252 to request a loan and TIAA see if you're eligible for a loan based upon outstanding loan balance and account fund availability.

- After availability verification, TIAA will provide you with a loan application.

- If you aren't eligible for a loan, a hardship can be processed. If you're eligible for the loan, please see procedures for loans.

- Read the TIAA FAQ about Loans

Hardship Withdrawal Administration Procedures from 403(b) Voluntary Retirement Plan

- You must have a 403(b) in place before applying for a hardship and have applied for a loan and been turned down prior to requesting a hardship withdrawal.

- Contact TIAA at 800.842.2252 to request the loan/hardship, whichever is applicable.

- Hardships are issued for mortgage payments, taxes, medical payments, funeral expenses and for post secondary college (employee and dependents).

- TIAA will verify if you're eligible for a loan based upon outstanding loan balance and account fund availability. If you aren't eligible for a loan, a hardship can be processed. If you're eligible for the loan, please see procedures for loans.

- After availability verification, TIAA will provide you with the hardship application which must be completed; signed by a designated person in the Benefits Office; and turned into TIAA.

- Upon receiving the notification from TIAA of the hardship approval, the Benefits Office will end your voluntary 403(b) supplemental retirement deduction and set it to begin again in six months.