Updating Your W-4 Information

In our continuing effort to GO GREEN Payroll is now offering employees the opportunity to update their federal withholding allowances/amounts electronically.

Note: For more information, contact the Payroll Department at 487.2393 or email [email protected].

Follow these directions to update your W-4 information:

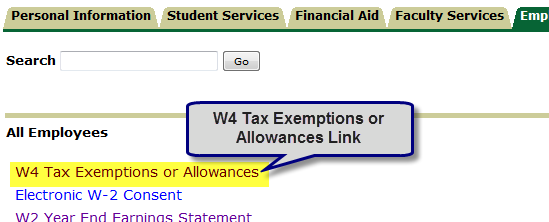

- Click the Tax Forms link.

- The All Employees menu is displayed. Click the W4 Tax Exemptions or Allowances link.

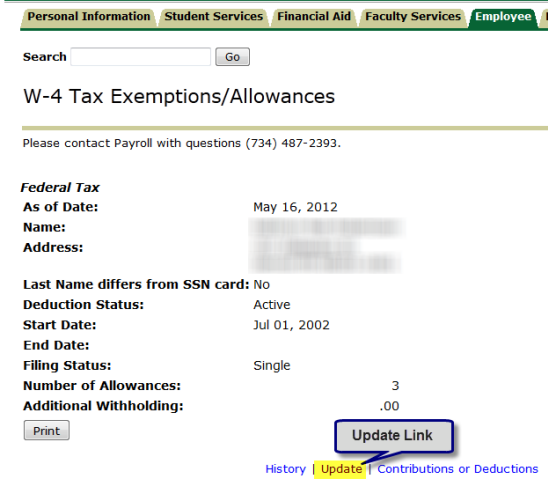

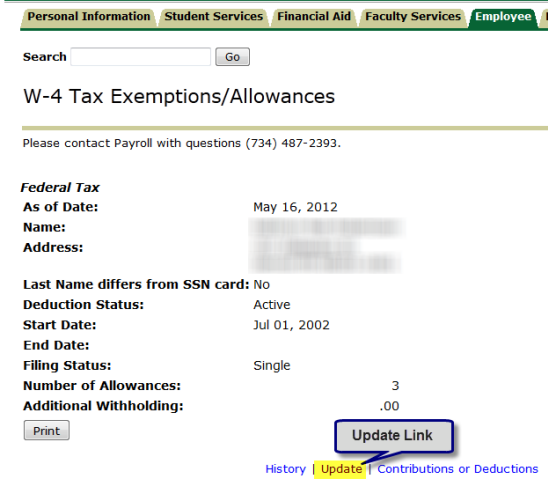

- The W-4 Tax Exemptions/Allowances page is displayed. To change any of the displayed information, click the Update button.

- Review and make any necessary changes.

Note: Review the information on this page and make any necessary changes to your filing status, number of allowances, and additional withholdings in the respective Filing Status, Number of Allowances, and Additional Withholdings fields. - Click the Certify Changes button.

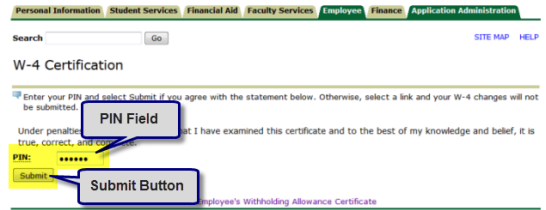

- The W-4 Certification page is displayed. Type your PIN in the PIN field.

Note: See Personal Information Menu Overview for more information. - Click the Submit button.

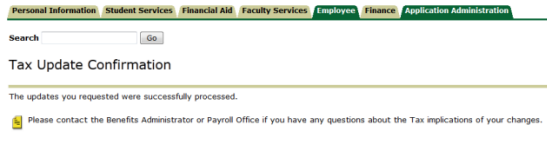

- The Tax Update Confirmation page is displayed.

Note: Your W-4 information has been updated.

- When you are finished, click the Employee tab to return to the Employee menu.