Announcements

Summer 2024 Payment Plan Due Dates and Billing Information

- Thursday, April 4, 2024 - Summer Bill Statement Sent via Email

- Thursday, April 18, 2024 - 4 Fee Free Payment Plan Due Date

- Friday, May 3, 2024 - First Summer Refund

- Thursday,May 9, 2024 - 3 Payment Plan Due Date and Semester Due Date

- Thursday, May 30, 2024

- Thursday, June 27, 2024

Service EMU

In-person advising is available at 268 Student Center

- Monday-Thursday, 8 a.m.-5 p.m.

- Friday, 9 a.m.-5 p.m.

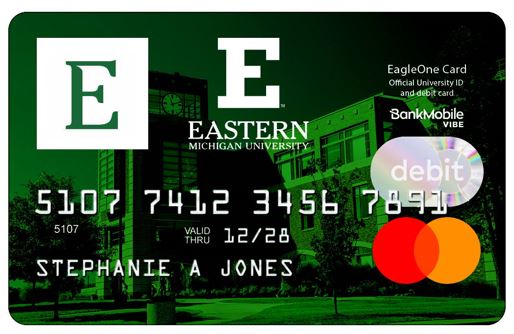

Are you looking for an Eagle OneCard?

Follow these steps to submit an online photo.

Attention Third Party Students

Due to the closing of Pierce Hall we are requesting that all tuition vouchers be scanned and emailed to [email protected]. Please direct all Third Party billing questions to this email address as well.

Attention MET Families

MET will apply to your account as charges are assessed. Adjustments may be needed if additional aid is awarded. If you are in the MET program, have your schedule set for the upcoming term, and need a review of credits please send an email to eBill.

1098T Information

SBS sent an email with the subject: "Important Tax Information needed," "Second Notice," and "FINAL Notice" from eBill requesting required tax information be provided by filling out the W9s form. If you elect not to submit the required information for the IRS you may be charged to process it in the future. All late filings are subject to a $50 fine.

Important Information for Summer 2024

- During the June 2022 meeting, the EMU Board of Regents approved the adoption of a Block Tuition pricing model. Undergraduate students taking between 12 and 16 credit hours will pay one flat rate of $7600. Additional information can be found under Tuition and Fees and explained here.

- The Summer 2024 Pay In Full Date is May 9, 2024

- Summer charges will be applied to the student accounts the week of April 1, 2024.

- Winter billing statement emails will begin being processed weekly, starting April 4, 2024.

- The Fee Free Four Payment Plan will be available April 4 through April 18, 2024. A down payment of 25% is due at sign up, this is the first installment of the payment plan. Once enrolled in the payment plan, the bill will be broken down into three additional installments and due dates will be as follows: May 9, May 30 and June 27, 2024.

A three payment plan will be available after April 18, 2024 till May 9, 2024. Pick the payment plan that works best for your financial needs.

- Call: 734.487.1219

- Email: [email protected]

- Mailing Address: 203 Pierce Hall, Ypsilanti, MI 48197